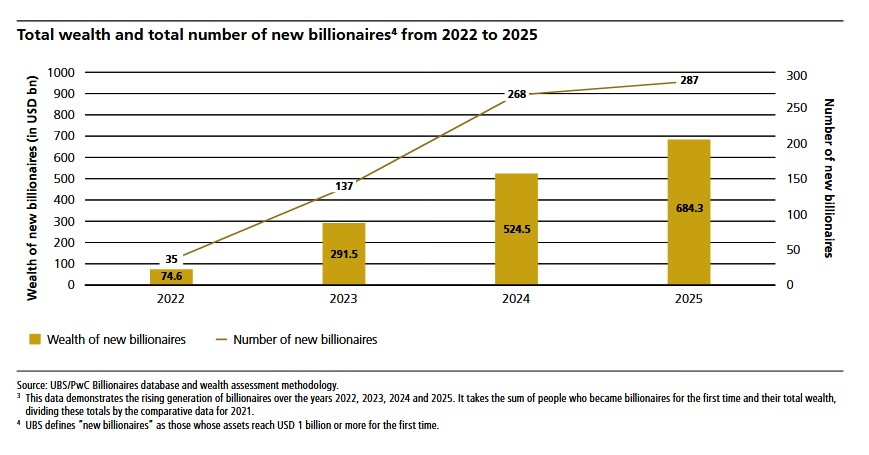

This year’s was driven by bold business creation and entrepreneurial success. From marketing software and genetics to liquefied natural gas and infrastructure, these innovators are reshaping demand at scale, with billionaires in the US and Asia-Pacific leading the charge,” UBS said.

The 60-page report examines how this UHNW group continues to warm to private markets, hedge funds – seen as a diversification play – and gold. For example, 96 per cent of those questioned intend to keep gold allocations where they are or raise them. Gold remains, as advocates say, a classic safe-haven asset.

Billionaires in motion

UBS said billionaires continue to be on the move, with 36 per cent saying they have relocated at least once, and 9 per cent indicating that they are considering doing so.

A better quality of life (36 per cent), major geopolitical concerns (36 per cent) and being able to organise tax affairs more efficiently (35 per cent) were the top reasons cited for relocating. This global movement adds complexity as families manage legal, cultural and financial challenges across borders.

Since Covid and a series of geopolitical upheavals, HNW and UHNW individuals have become more focused on living in places that are safe, have strong healthcare and education, robust rule of law, and low relative debt burdens, Benjamin Cavalli, head of strategic clients and global connectivity at UBS Global Wealth Management and co-head EMEA OneUBS, told this news service during a media webinar yesterday. People will continue to favour countries such as Switzerland, Singapore and the United Arab Emirates, among others, Cavalli said.

Transfer accelerating

The wealth transfer is also accelerating, the report said. In 2025, 91 heirs (64 men and 27 women) inherited a record $297.8 billion – 36 per cent more than in 2024, despite fewer people inheriting overall. Globally, inheritance bolstered the number of multi-generational billionaires, with some 860 now overseeing assets of $4.7 trillion, up from 805 with $4.2 trillion in 2024.

The number of second-generation billionaires grew by 4.6 per cent, third-generation by 12.3 per cent, and fourth-generation and beyond by 10 per cent. This underlines why wealth transfer continues to be a major focus in today’s wealth sector.

Women’s wealth

Women’s average wealth continued to rise in 2025, up 8.4 per cent to $5.2 billion. That is more than double the growth rate for men (3.2 per cent, to $5.4 billion). While women now make up 374 billionaires versus 2,545 men, they have outpaced men in terms of wealth accumulation for four consecutive years.

Sectors

Billionaires who invested in the technology sector saw their wealth rise by 23.8 per cent. By contrast, consumer and retail growth slowed to 5.3 per cent as the European luxury industry lost momentum to Chinese brands. Despite this, the sector is still the largest, at $3.1 trillion.

Industrial wealth recorded the fastest rise, up 27.1 per cent to $1.7 trillion, with over a quarter of that coming from new billionaires. Wealth in the financial services sector climbed 17 per cent to $2.3 trillion, driven by strong markets and a rebound in cryptocurrency, with self-made billionaires accounting for 80 per cent of total wealth.

Family dynamics

The generational shift is reshaping family dynamics and investment priorities. More than eight in 10 billionaires with children surveyed said they want their children to succeed independently, valuing skill development over reliance on inherited wealth. More than two-thirds hope their heirs will pursue their own passions, and more than half would like them to use their wealth to make a positive impact on the world.

In an age when entrepreneurs frequently appoint professional management or sell their businesses rather than pass them to the next generation, 43 per cent still hope to see their children carry on and grow the family business, brand or assets, ensuring that the legacy continues.

Investment priorities

Despite 2025’s market volatility, North America remains the top investment destination (63 per cent), followed by Western Europe (40 per cent) and Greater China (34 per cent). With renewed confidence in Greater China and the broader Asia-Pacific region, 42 per cent of billionaires plan to increase exposure to emerging markets equities over the next 12 months. Among developed market equities, more than four in 10 (43 per cent) plan to increase exposure, while 7 per cent intend to reduce it.

Many billionaires also intend to increase their exposure to private equity (direct investments and funds/funds of funds), hedge funds and infrastructure over the next 12 months. Topping the list of concerns for the coming year are tariffs (66 per cent), major geopolitical conflict (63 per cent) and policy uncertainty (59 per cent).

In other findings, the survey found that 66 per cent of respondents said tariffs would harm the market environment in the coming 12 months, while 63 per cent said major geopolitical conflict would do so. Fifty-nine per cent cited "policy uncertainty." Only 5 per cent mentioned the risk of "deflation."

Looking ahead, the next few decades will see a rising number of billionaires and centi-millionaires as the "Great Wealth Transfer" accelerates, the bank said. Billionaires are estimated to transfer about $6.9 trillion of wealth globally by 2040, with at least $5.9 trillion set to be passed to children, either directly or indirectly, through spouses.

UBS conducted an online survey of its billionaire clients booked in Switzerland, Europe (excluding Switzerland), Singapore, Hong Kong SAR and the US between 10 July and 25 September, 2025. The total sample size was 87 respondents. The survey findings were supplemented by in-depth interviews between 27 September and 7 October. The report also draws on the UBS/PwC billionaire database, which has tracked billionaire wealth across the Americas, EMEA and Asia-Pacific (47 markets) since 1995.